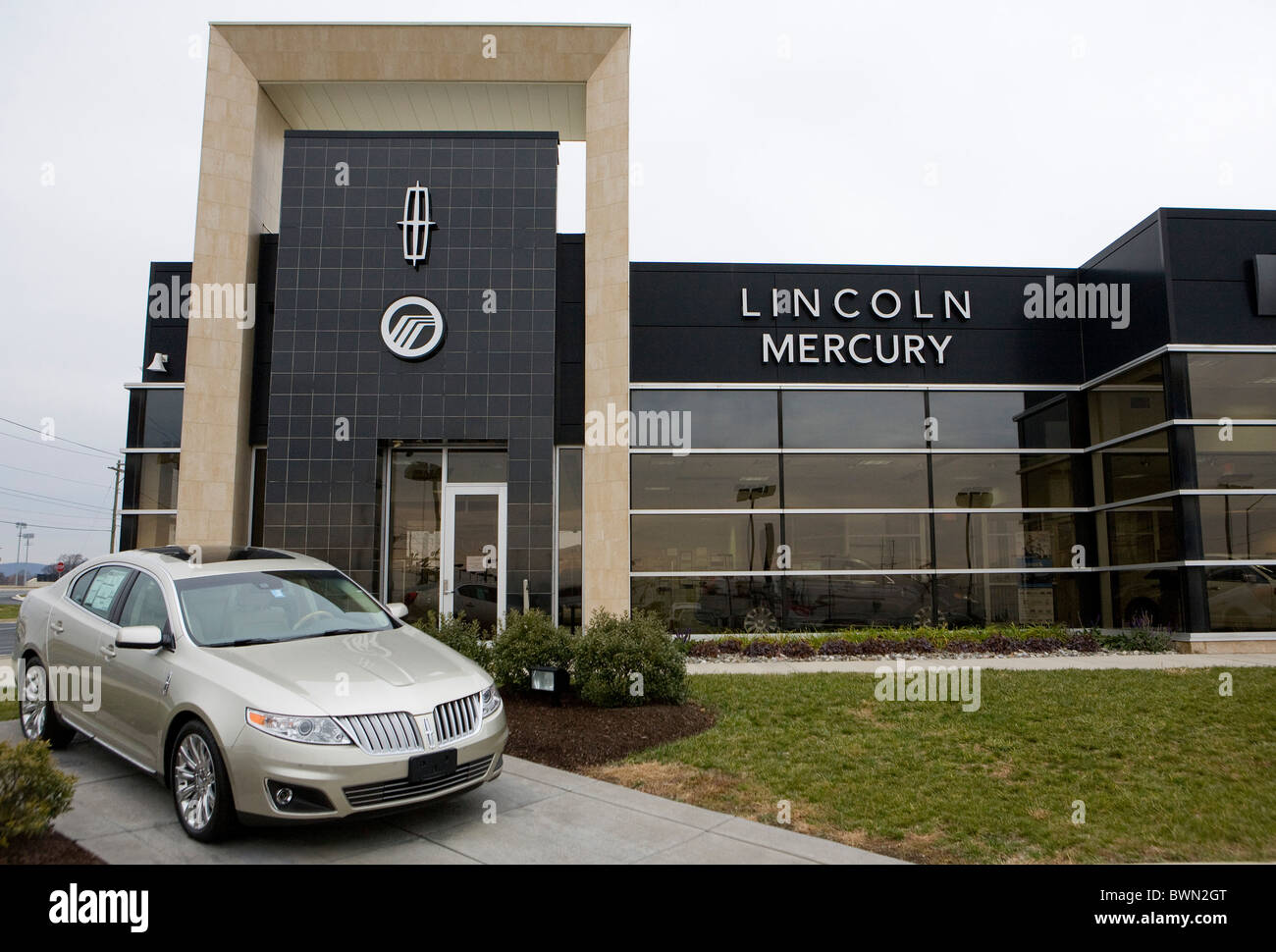

Check out the High-end of Lincoln Continental at Varsity Lincoln Dealerships

Check out the High-end of Lincoln Continental at Varsity Lincoln Dealerships

Blog Article

Extensive Analysis of Cars And Truck Leasing Options: Finding the Ideal Fit

When considering an automobile lease, aspects such as lease terms, end-of-lease options, and the comparison in between leasing and purchasing all play an essential function in making an informed decision. By checking out the complexities of various leasing arrangements and understanding just how to discuss positive lease bargains, one can pave the way in the direction of a economically audio and enjoyable leasing experience.

Kinds Of Automobile Leasing Agreements

When thinking about automobile leasing alternatives, people can select from various sorts of renting arrangements customized to their details needs and preferences. The two key kinds of vehicle leasing contracts are closed-end leases and open-end leases. Closed-end leases, likewise called "walk-away leases," are the most typical kind of customer lease. In this agreement, the lessee returns the vehicle at the end of the lease term and is not responsible for any type of added expenses beyond excess gas mileage and deterioration. Open-end leases, on the other hand, are much more commonly used for industrial leasing. In an open-end lease, the lessee is accountable for any distinction between the residual value of the lorry and its actual market worth at the end of the lease term. Additionally, there are also specialized leases such as sub-leases and lease presumptions, which permit for special arrangements between the lessor and lessee. Comprehending the different kinds of leasing arrangements is essential for individuals looking to rent an auto that lines up with their economic goals and use needs.

Elements Affecting Lease Terms

When getting in right into an automobile leasing agreement,Understanding the vital elements that influence lease terms is necessary for people seeking to make informed choices. One crucial factor is the lorry's depreciation. The rate at which a vehicle sheds value over time substantially affects lease terms. Cars with lower depreciation prices frequently result in extra favorable lease terms. Another essential element is the lease term length. Shorter lease terms typically come with reduced rate of interest however greater month-to-month settlements. On the other hand, longer lease terms could have reduced regular monthly repayments however can wind up costing extra because of building up interest in time. The lessee's debt rating likewise plays a substantial function in figuring out lease terms. A higher credit history can lead to lower rates of interest and much better lease conditions. Furthermore, the worked out market price of the lorry, the cash variable established by the leasing company, and any kind of deposit or trade-in value can all influence the last lease terms used to the person - varsity lincoln.

Comprehending Lease-End Options

What are the vital considerations for lessees when it comes to evaluating their lease-end choices? As the lease term approaches its final thought, lessees must very carefully examine their lease-end alternatives to make educated choices. One crucial consideration is comprehending the various choices available, such as returning the lorry, purchasing it outright, or exploring lease expansions. Evaluating the vehicle's present problem is likewise vital, as too much deterioration or surpassing the gas mileage restriction might incur surcharges upon return. Lessees ought to familiarize themselves with any type of end-of-lease fees that might apply and contrast them to the costs linked with buying the car. Planning in advance is important, and lessees must begin exploring their choices well prior to the lease expiration day to prevent any kind of final choices. Furthermore, thinking about future demands and preferences can assist in establishing whether to rent a brand-new vehicle, extend the current lease, or choose a various vehicle purchase technique. By meticulously assessing these aspects, lessees can browse their lease-end choices properly and make the very best choice for their circumstances.

Comparing Leasing Vs. Purchasing

Tips for Working Out Lease Bargains

When working out lease deals for an auto, it is important to completely research and understand the terms and problems supplied by different car dealerships. Begin by determining the kind of car you require and how numerous miles you generally drive in a year. This details will certainly assist you discuss a lease with the proper gas mileage allocation to avoid excess gas mileage costs at the end of the lease term.

Another suggestion is to ask about any available lease motivations, such as rebates or special promotions, that can aid lower your regular monthly repayments. Furthermore, think about bargaining the capitalized expense, which is the first cost of the car before fees and taxes. Goal to reduce this cost with negotiation or by trying to find lorries with high residual worths, as this can cause extra appealing lease terms.

In addition, thoroughly examine the lease agreement for any kind of covert charges or charges, and do not hesitate to ask concerns or seek explanation on any uncertain terms. By being knowledgeable and prepared to work out, you can secure a favorable lease offer that fulfills your demands get more and spending plan.

Final Thought

Recognizing the kinds of leasing contracts, factors affecting lease terms, and lease-end alternatives is essential in making a notified choice. Take into consideration all aspects carefully to discover the excellent fit for your auto renting requirements.

When thinking about a car lease, elements such as lease terms, end-of-lease choices, and the comparison in between leasing and purchasing all play a crucial duty in making an educated decision. Closed-end leases, additionally known as "walk-away leases," are the most usual type of customer lease. In an open-end lease, the lessee is responsible for any kind of distinction between the residual worth of the car and its real market worth at the end of the lease term. Furthermore, the negotiated selling rate of the car, the cash variable established by the leasing firm, and any down repayment or trade-in value can all affect the her response final lease terms provided to the person.

Comprehending the kinds of leasing contracts, factors influencing lease terms, and lease-end choices is essential in making read this article a notified choice.

Report this page